The cryptocurrency world is buzzing with excitement as Bitcoin reaches an all-time high of $92,000 in November 2024. This milestone marks a pivotal moment, solidifying Bitcoin’s status as a dominant asset class while sparking discussions about its future trajectory. But how did Bitcoin manage to break this new barrier? Let’s dive into the factors driving this unprecedented surge and what it could mean for the future of crypto.

The Driving Forces Behind Bitcoin’s $92K Breakthrough

- Institutional Influx Through ETFs

- Inflows into Bitcoin ETFs have exceeded $22 billion in less than a year, showcasing growing institutional trust.

- ETFs have democratized Bitcoin investing, making it accessible to traditional market players without requiring direct wallet management.

- Retail FOMO and Market Psychology

- Retail investors are back in force, fueled by fear of missing out (FOMO) as Bitcoin closes in on the mythical $100,000 milestone.

- Trading activity has surged, with Bitcoin’s 24-hour volume exceeding $55 billion.

- Psychological barriers, like breaking the $90K resistance, have amplified bullish sentiment across the market.

- U.S. Strategic Bitcoin Reserve Proposal

- Speculation about the U.S. establishing a Strategic Bitcoin Reserve has created a bullish narrative. This would cement Bitcoin’s position as a global strategic asset, akin to gold.

- Miner Activity and Supply Dynamics

- Even as miners offload holdings to secure profits—approximately $10 billion worth recently—strong buying demand from retail and institutional investors has prevented any significant price retracement.

- The upcoming 2025 halving is already reducing supply as miners hold onto reserves in anticipation of higher prices.

- Macro-Economic and Geopolitical Trends

- Inflation Hedge: Investors continue to turn to Bitcoin as a store of value against inflation.

- De-dollarization: Countries exploring alternatives to the U.S. dollar in trade and reserves are increasingly looking at Bitcoin as a viable solution.

- The Trump Factor: A Pro-Crypto Presidency

- Another significant development influencing Bitcoin’s recent rally is the return of Donald Trump as President of the United States. Trump’s administration is perceived as pro-crypto, with indications that the new policies could favor the adoption and integration of cryptocurrencies into the broader financial system.

- His presidency has sparked optimism about clearer and more favorable regulatory frameworks for digital assets. Such a stance not only encourages institutional participation but also legitimizes Bitcoin as a strategic asset within the U.S. economy.

- The anticipation of crypto-friendly policies under Trump has likely contributed to the current bullish sentiment surrounding Bitcoin.

What’s Next for Bitcoin and the Crypto Market?

Bitcoin’s Journey to $100K

With momentum building, the question on everyone’s mind is whether Bitcoin can sustain its rally to hit $100,000. Factors to watch include:

- Continued ETF inflows.

- Retail and institutional activity during the next price consolidation phase.

- Regulatory clarity, which could either propel or hinder adoption.

Ripple Effects on the Crypto Ecosystem

Bitcoin’s surge is lifting the broader crypto market:

- Altcoins like Ethereum and Solana are experiencing renewed interest.

- Total crypto market capitalization has climbed, approaching $3 trillion, putting it on par with the GDP of France.

Conclusion: The Moon is Just the Beginning

Bitcoin’s rise to $92,000 represents more than just financial gain; it signals a shift in how the world views digital assets. From institutional adoption to macroeconomic shifts, Bitcoin is no longer just a speculative asset—it’s becoming an integral part of the global financial system.

As the world watches Bitcoin’s next moves, one thing is clear: the journey from boom to moon is far from over. The $100K milestone isn’t a question of if, but when.

Related Posts

Empowering Business Analysts: How AI is Revolutionizing Agile Practices

In today's fast-paced digital landscape, Agile methodologies are no longer optional— they're essential for organizations…

What is SAP? How does it work?

The full form of "SAP" is “Systems Applications and Products in Data Processing” which is…

Optimizing React Performance: An Advanced Guide for Scalable Applications

In today’s fast-paced digital ecosystem, software systems have become the backbone of every enterprise’s technological…

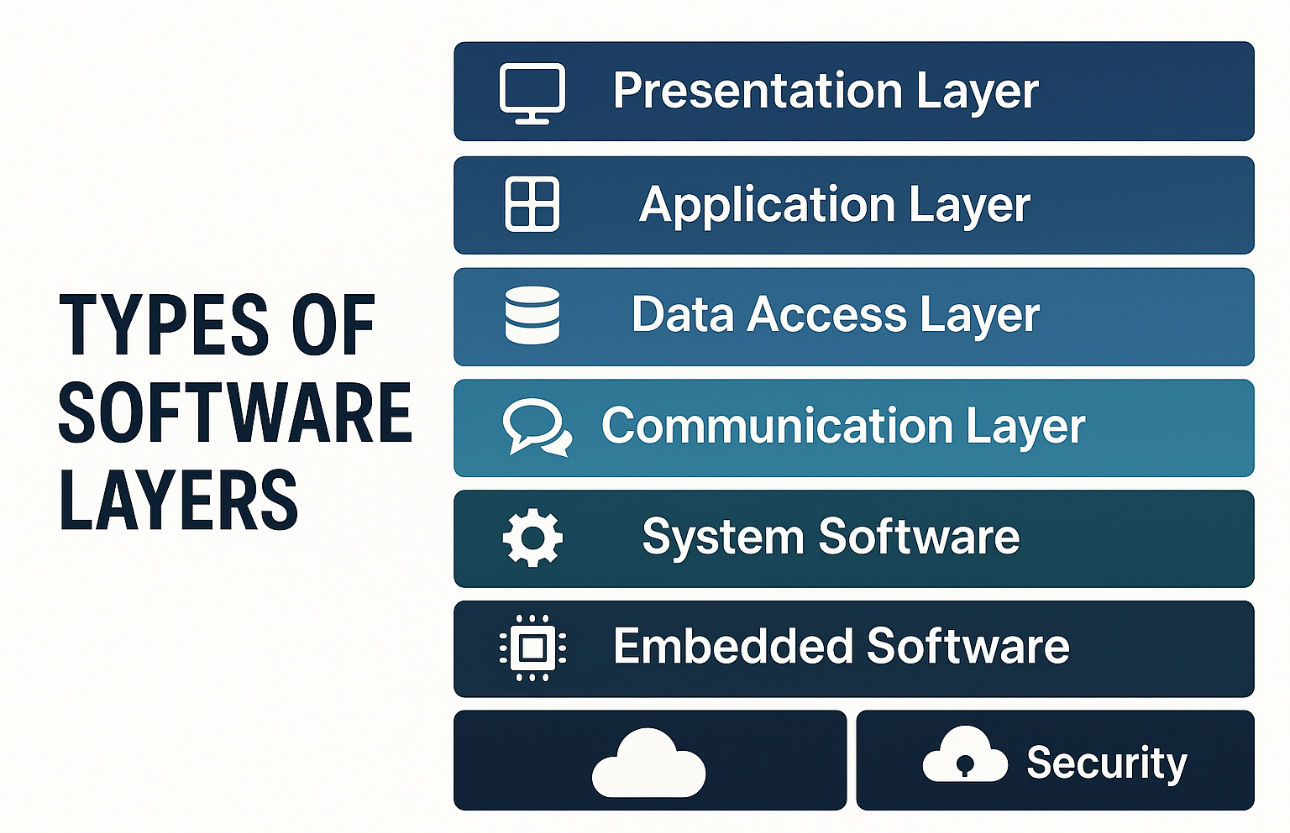

Types of Software Layers

In today’s fast-paced digital ecosystem, software systems have become the backbone of every enterprise’s technological…